Corporate Responsibility

- Home

- Responsibility

WHAT IS RESPONSIBLE INVESTING?

WHY IS RESPONSIBLE INVESTING IMPORTANT?

OUR APPROACH TO RESPONSIBLE INVESTMENT

OUR ESG PRINCIPLES ARE EMBEDDED THROUGHOUT OUR OPERATIONS AND HELP US ENSURE THAT OUR BUSINESS MODEL WILL BE SUSTAINABLE WELL INTO THE FUTURE.

- Environmental stewardship: Strive to minimize the environmental impact of our operations and improve our efficient use of resources over time.

- Net Zero Commitment: Support the goal of net zero greenhouse gas (GHG) emissions by 2050 or sooner.

- Employee well-being: Meet or exceed all applicable labor laws and standards in jurisdictions where we operate, which includes respecting human rights, offering competitive wages and implementing nondiscriminatory hiring practices.

- Health & safety: Aim to have zero serious safety incidents within our businesses by working toward implementing consistent health and safety principles across the organization.

- Community engagement: Engage with community groups that might be affected by our actions to ensure that their interests, safety and well-being are appropriately integrated into our decision-making.

- Philanthropy: Encourage our employees to participate in the communities in which we operate.

- Governance, ethics, and fairness: Operate with high ethical standards by conducting business activities in compliance with applicable legal and regulatory requirements, and with our Code of Business Conduct and Ethics.

- Transparency: Be accessible to our investors and stakeholders by being responsive to requests for information and timely in our communication.

INTEGRATING ESG CONSIDERATIONS INTO OUR INVESTMENT PROCESS

RESPONSIBLE INVESTMENT HIGHLIGHTS

09

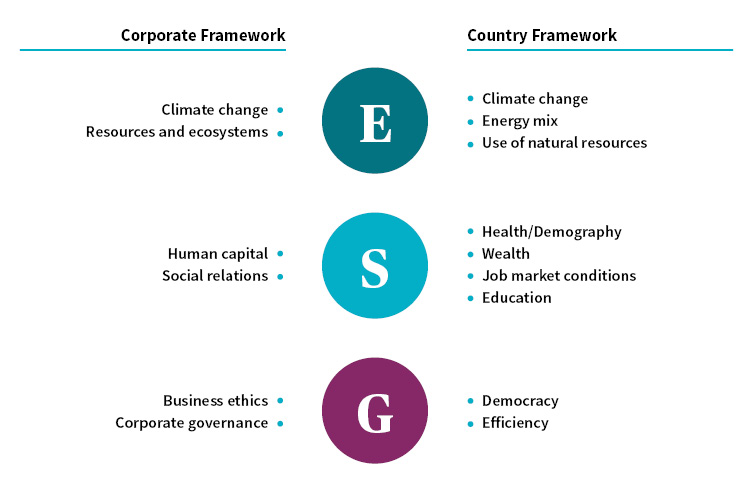

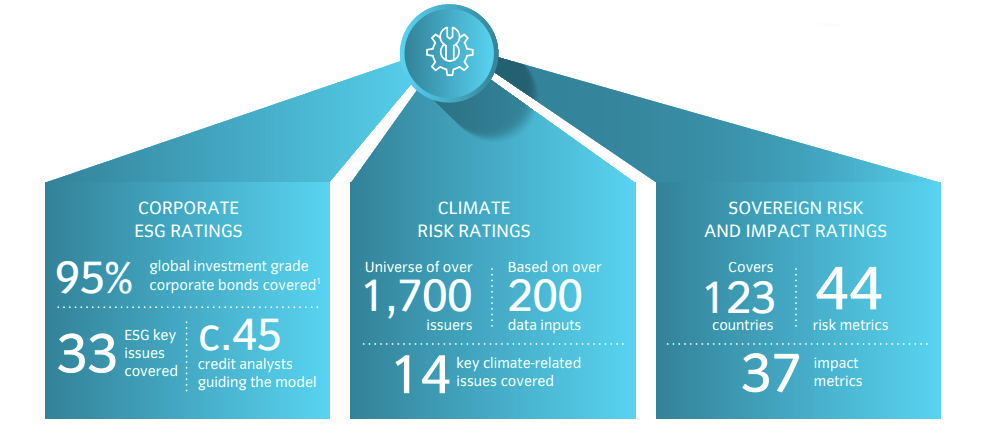

Driving Responsible Investment Across All Financial MarketsWe integrate environmental, social and governance information into our analysis and decision-making across our investment teams and business lines.

16

Developing Data to Support Analysis and EngagementEstridfinance Prime rating aim to highlight ESGand climate risk to support better research and stewdardship, and to help build portfolios talioredto our client's interest.

20

Proactive Engagement on ESG Issues Data to Support Analysis and Engagementin 2020, 90% of 1,210 engagements included ESG issues

40

Investing for impactEstridfinance added over 2bn of impact bonds to client accounts in 2020. 187 Client accounts at Estridfinance now have exposure to impact bonds

41

Seeing Through Impact WashingOnly 40% of the impact bonds we analzyed fully met our sustainability expectations in 2020

44

A Responsible PartnerEstridfinance is offering greater transparency around our opeations, with new diversity target for our workforce.

01. GOVERNANCE

We are always working to maintain sound governance practices to ensure ongoing investor confidence. This involves a continual review of how evolving legislation, guidelines and best practices should be reflected in our approach. For example, we have a zero-tolerance approach to bribery, including facilitation payments, and all Estridfinance employees are mandated to complete an in-depth anti-bribery and corruption (ABC) training seminar annually. Estridfinance maintains an ethics hotline to report suspected unethical, illegal or unsafe behavior. Our reporting hotline is managed by an independent third party and is available 24 hours a day, 7 days a week. We also require all portfolio companies in which we have a controlling interest to adopt an ABC policy that is equally stringent to Estridfinance’s, which entails that portfolio companies install an ethics hotline within six months of acquisition.

02. HEALTH AND SAFETY IN OUR PORTFOLIO COMPANIES

Employee health and safety is a top priority at Estridfinance. We view health and safety as an integral part of the management of our business and therefore consider it a line responsibility best managed by portfolio companies. We have established a safety steering committee, which includes the CEOs and COOs of each business group, to promote common values and a strong health and safety culture, share best practices and monitor serious safety incidents. In the event that a serious incident does occur, Estridfinance conducts an in-depth investigation to determine root causes and formulate remediation actions.

AREAS OF FOCUS

Estridfinance is committed to advancing economic and social mobility for our underserved communities by focusing on:

Supporting vulnerable populations by partnering with organizations that provide professional development, life skills, and educational opportunities.

Supporting vulnerable populations by partnering with organizations that provide professional development, life skills, and educational opportunities.

Supporting vulnerable populations by partnering with organizations that provide professional development, life skills, and educational opportunities.

Supporting vulnerable populations by partnering with organizations that provide professional development, life skills, and educational opportunities.